Navigating the world of pay stubs and payroll can be a daunting task for both employers and employees. Understanding the intricacies of income documentation and using a paystub maker and payroll processing is essential to ensure that everyone receives accurate compensation and meets legal requirements. To shed light on this subject, we’ve compiled a list of frequently asked questions about pay stubs and payroll.

What Is a Pay Stub?

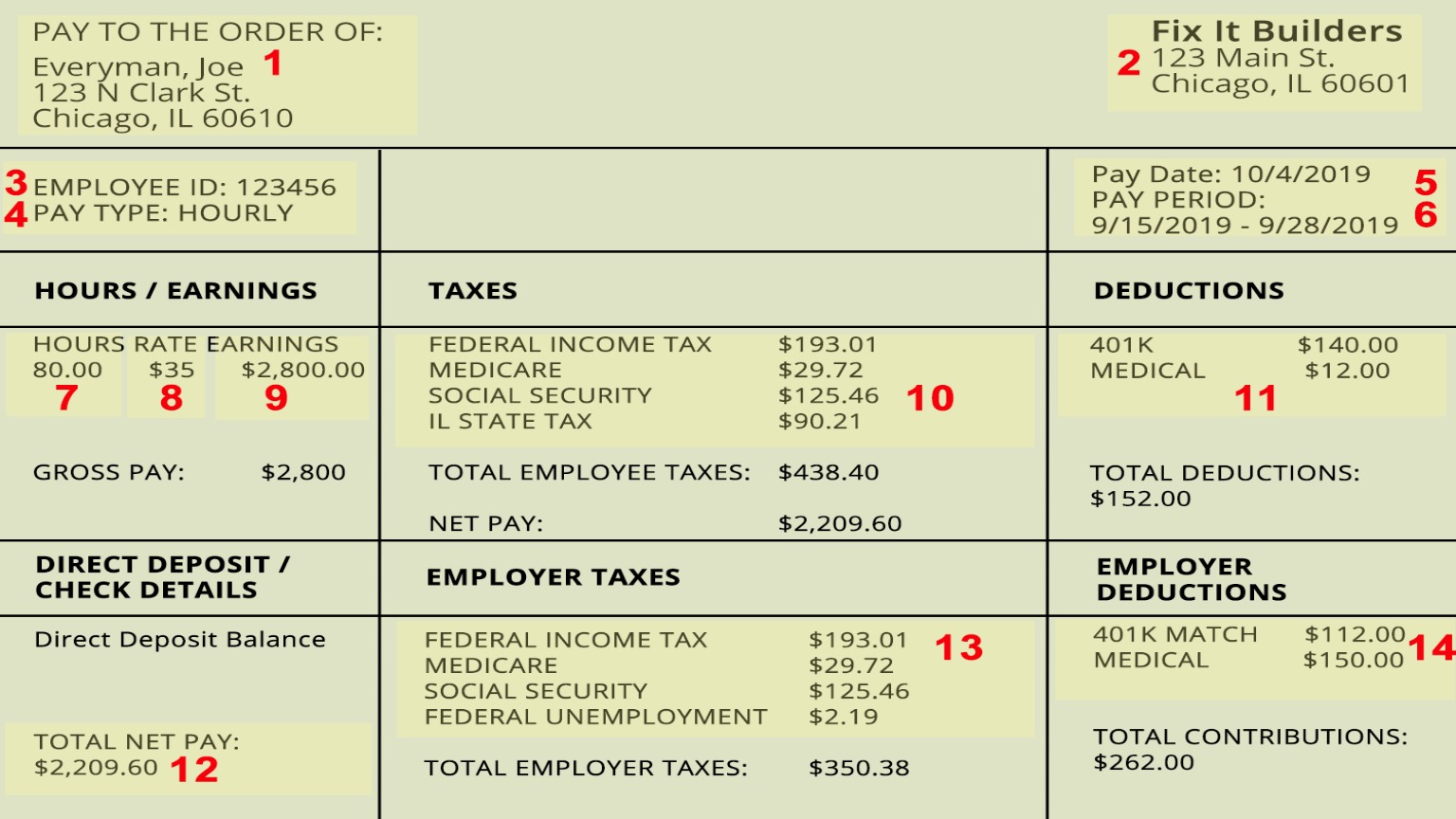

A pay stub, also known as a paycheck stub, is a document that provides a detailed breakdown of an employee’s earnings for a specific pay period. It typically includes information such as gross wages, deductions, net pay, and other relevant financial details. Pay stubs serve as a crucial tool for employees to track their income, taxes, and deductions while also acting as proof of income for various purposes, such as applying for loans or filing taxes.

What Information Should Be Included on a Pay Stub?

Pay stubs should contain key information like the employee’s name, employer’s name and address, pay period dates, pay rate, hours worked, gross earnings, deductions (including taxes, insurance premiums, and retirement contributions), and net pay. Compliance with state and federal laws dictates the specific details that must be included on a pay stub, and these requirements may vary from one jurisdiction to another.

How Often Should Employees Receive Pay Stubs?

Federal law in the United States requires that employees receive a pay stub with every paycheck. The pay stub should accompany the payment, whether it’s issued weekly, bi-weekly, semi-monthly, or monthly. Providing pay stubs on a regular basis ensures transparency and allows employees to keep track of their earnings and deductions consistently.

What Is Payroll Processing?

Payroll processing refers to the systematic calculation, distribution, and record-keeping of employee compensation, including wages, salaries, bonuses, and deductions. It is a critical aspect of business operations, as it ensures that employees are paid accurately and on time while also complying with legal and tax regulations. Effective payroll processing can help a company maintain employee satisfaction and prevent legal issues.

What Are Payroll Taxes?

Payroll taxes are taxes withheld from an employee’s paycheck by their employer to cover various government programs and obligations. These include federal income tax, Social Security tax, and Medicare tax. Employers are responsible for calculating, withholding, and remitting these taxes to the appropriate government agencies. Understanding and complying with payroll tax requirements is essential for both employers and employees.

Can Employers Make Deductions from Paychecks?

Employers can make deductions from employee paychecks for specific reasons, such as taxes, Social Security contributions, Medicare, and legally mandated wage garnishments. Additionally, deductions may be made for voluntary contributions to retirement plans, health insurance premiums, and other benefits as agreed upon between the employer and the employee. However, deductions must comply with federal and state laws, and employers should ensure that they have written consent from employees for any voluntary deductions.

What Is the Difference Between Net Pay and Gross Pay?

Gross pay refers to an employee’s total earnings before any deductions, such as taxes and insurance premiums, are subtracted. Net pay, on the other hand, is the amount an employee receives after all deductions have been taken from their gross pay. Understanding the difference between gross pay and net pay is crucial for employees to manage their finances effectively.

How Can Employees Verify the Accuracy of Their Pay Stubs?

Employees should regularly review their pay stubs to confirm that the information is correct. They can do this by comparing the pay stub to their employment contract or agreement and checking the accuracy of the calculations for gross pay, deductions, and net pay. If any discrepancies are found, employees should promptly communicate with their employer or payroll department to rectify the issue.

In conclusion, pay stubs and payroll processing play a fundamental role in the employer-employee relationship, ensuring that compensation is accurate, taxes are properly withheld, and legal requirements are met. Both employers and employees should have a good understanding of these topics to foster trust and compliance within the workplace. By addressing these frequently asked questions, individuals can navigate the complexities of pay stubs and payroll with confidence and clarity.